The president defended the new health care law this afternoon in Boston. His remarks were predictable, but he had a few hecklers. This is how he handled the moment.

(The half-hour speech is now up at C-SPAN Video Library if anyone is interested.)

Hootsbuddy's New Place is the successor to Hootsbuddy's Place (2004-2009) Still accessible via Web search.

Wednesday, October 30, 2013

Tuesday, October 29, 2013

HCR -- Junk Health Insurance Is Now Obsolete

Chris Hayes:

"You will no longer be permitted to buy

a really crappy health insurance policy.

Just as under financial reform, lots of folks

are no longer permitted to buy

heinously destructive adjustable rate

balloon payment mortgages"

.

Immigration Myths and Facts

MYTH: Undocumented immigrants don't pay taxes. Get the facts - http://t.co/yHkm9sDpFF #Ready4Reform

— U.S. Chamber (@USChamber) October 28, 2013

MYTH: Undocumented immigrants don't pay taxes. Get the facts - http://t.co/yHkm9sDpFF #Ready4Reform

— U.S. Chamber (@USChamber) October 28, 2013

►This headline is a hot link to a comprehensive policy paper.

Go to the link for a multitude of details.

The original piece is embedded in the next post, but the font is very small.

The original has alternative download options -- pdf, etc.

Go to the link for a multitude of details.

The original piece is embedded in the next post, but the font is very small.

The original has alternative download options -- pdf, etc.

JOBS

MYTH: Every job filled by an immigrant is a job that could be filled by an unemployed American.WAGES

FACT: Immigrants typically do not compete for jobs with native-born workers and immigrants create jobs as entrepreneurs,consumers, and taxpayers.

MYTH: Immigrants drive down the wages of American workers.

FACT: Immigrants give a slight boost to the average wages of Americans By increasing their productivity and stimulating investment

ECONOMY

MYTH: The sluggish U.S. economy doesn't need more immigrant workers.UNEMPLOYMENT

FACT: Immigrants will replenish the US. labor force as millions of Baby Boomers retire.

MYTH: At a time of high unemployment, the U.S. economy does not need temporary foreign workers.HIGH-TECH WORKERS

FACT: Temporary workers from abroad fill specialized needs in specific sectors of the U.S. economy.

MYTH: There is no shortfall of native-born Americans for open positions in the natural sciences, engineering, and computer science and thus no need for foreign-born high-tech workers.COMMUNITY IMPACT

FACTS: Job openings are expanding at educational levels where demographic data show too few native-born students, so we can expect these shortfalls to persist in the future. * See note below Moreover, relative to other economic indicators, wages are increasing in STEM jobs (Science, Technology, Engineering, Math) requiring higher education.

MYTH: Immigrants hurt communities that are struggling economically.TAXES

FACT: Immigrants have economically revitalized many communities throughout the country.

MYTH: Undocumented immigrants do not pay taxes.

FACT: Undocumented immigrants pay billions of dollars in taxes each year

WELFARE

* Note:

Regarding high-tech workers, there IS a shortfall of candidates. Many companies are solving two problems at once by bringing in foreign-born workers with H1B visas to learn high-tech jobs in order to return home where they will coach others who will do those jobs at lower wages. Call it "outsourcing" if you want, but if the education standards of US schools don't generate the numbers required, transnational companies must look elsewhere for a solution.

MYTH: Immigrants come to the United States for welfare benefits.

FACT: Undocumented immigrants are not eligible for federal public benefit programs, and even legal immigrants face stringent eligibility restrictions.

~~~~~~~~~~~~~~~~~~~~~~~~~

* Note:

Regarding high-tech workers, there IS a shortfall of candidates. Many companies are solving two problems at once by bringing in foreign-born workers with H1B visas to learn high-tech jobs in order to return home where they will coach others who will do those jobs at lower wages. Call it "outsourcing" if you want, but if the education standards of US schools don't generate the numbers required, transnational companies must look elsewhere for a solution.

Monday, October 28, 2013

HCR -- High-Deductible Plans Sticker Shock

The rules have changed. Health care plans now must actually insure better health care. Insurance plans must pay at least 60 percent of allowed medical expenses and cap annual out-of-pocket spending at $6,350 for individuals and $12,700 for families. This means those so-called "catastrophic coverage" plans, growing in popularity as the costs of health care continue to go up, now have limits.

But why?

This by Dr. James Knickman, a New York public health policy authority, formerly with the Robert Wood Johnson Foundation at Princeton, says this:

The Downside of High-Deductible Health Plans

[...] The logic is that these plans, with an average annual deductible of around $2,000 for individuals and $4,000 for family coverage (although there is considerable range in these options), force consumers to have "skin in the game" and make smarter choices about health care. But, on the flip side, might people also delay or forego care when they really need it if they know they're on the hook for a huge deductible?

The answer, perhaps not surprisingly, is that it depends. Two recent studies have found important disparities in the use of care among patients enrolled in high-deductible plans.

One study, in the journal Health Affairs, found that people of high socioeconomic status enrolled in high-deductible health plans did cut their use of emergency department visits for lower-severity conditions (those that don't actually require emergency services), by 15-20%. And this group's appropriate use of emergency care for serious conditions did not change.

On the other hand, people of lower socioeconomic status who were enrolled in high-deductible plans reduced their emergency department use for serious health conditions--like flare-ups of asthma or congestive heart disease--by 25-30%. [* See note below.]

Hospitalizations among patients with lower socioeconomic status also declined in the first year of the study, by 23%, but jumped in the second year, suggesting that delayed care led to even more serious illness requiring hospitalization.

Another study, in the journal Medical Care, found similar disparities according to gender, with men enrolled in high-deductible plans more likely than women with the same health care coverage to put off needed care for serious issues like kidney stones or chest pain, and ultimately to have higher hospitalization rates.

These findings are timely, as high-deductible plans are growing in popularity. The rate of enrollment in high-deductible plans has more than doubled since 2009. More than one-third of workers today have an annual deductible of $1,000 or more, in part because Obamacare requires that many important preventive services--regular check-ups, some cancer screenings--be delivered free of charge. And, as Obamacare is fully implemented and the mandates for individuals to have health care coverage and most businesses to offer coverage to their employees, even more Americans--particularly those who work for small businesses--are expected to opt for high-deductible plans, given that they will be among the least expensive options on the new health insurance exchanges.* In other words, people with higher incomes with high-deductible plans do save health care costs in two ways. First, a few (15%-20%) look for competitive prices when getting treatment for non-emergency issues and only go to the emergency for real emergencies. But about a fourth (23%) of lower-income people with the same plans appear not to spend as much for medical issues and actually get hospitalized more the second year, having neglected taking care of themselves to save money.

==► Remember, this legislation is intended to correct two glaring problems.

First, the costs of health care in America is the highest in the world and growing at an unsustainable rate. Second, too many people get zero routine care and use emergency care inappropriately, thus adding to soaring medical care costs for everyone.

This is from an article in Washington Post underscores many of the same points.

Low-premium, high-deductible health plans are endangered by Affordable Care Act

Rod Coons and Florence Peace pay $403 a month for a family health plan that covers barely any medical care for either of them until he or she reaches up to $10,000 in claims in a given year. And that’s just the way they like it.

“I’m only really interested in catastrophic coverage,” says Coons, 58, who retired last year after selling an electronics manufacturing business in Indianapolis. Beyond their premium, the couple typically spends no more than $500 annually on medical care, Coons says. “I’d prefer to stay with our current plan.”

That won’t be an option next year. In 2014, plans sold on the individual and small-group markets will have to meet new standards for coverage and cost-sharing, among other things. In addition to providing 10 so-called essential health benefits and covering many preventive-care services at no cost, plans must pay at least 60 percent of allowed medical expenses and cap annual out-of-pocket spending at $6,350 for individuals and $12,700 for families. (The only exception is for plans that have grandfathered status under the law.)

Plans with $10,000 deductibles won’t make the cut, experts say, nor will many other plans that require high cost-sharing or provide limited benefits — by excluding prescription drugs or doctor visits from coverage, for example. Plans next year can continue to be linked to a health savings account, however.

According to the Department of Health and Human Services, based on the 10 states (and the District) that have so far proposed individual market premiums for next year, the average monthly rate will be $321 per person for a mid-level plan.

Many policyholders don’t realize their current plans won’t meet the standards set by the Affordable Care Act next year.

When the online health insurance agency eHealthinsurance began notifying people in non-grandfathered plans that they’d have to change policies in January, the company got so many calls that it shut down the planned week-long e-mail campaign after one day.

Carrie McLean, the company’s director of customer care, says people who got the e-mail “said, ‘What are you talking about? I thought I was already on an ACA plan.’ ”Obamacare deductibles may cause sticker shock

Coons is none too pleased, either. “I’m happy with where I’m at right now, but it doesn’t look like that’s where I’m going to be at in the future,” he says. Coons plans to look for coverage through the online state marketplace. The couple may qualify for subsidies available to people with incomes up to 400 percent of the federal poverty level ($62,040 for a couple in 2013).

Insurance companies are requiring higher out-of-pocket expenses to pay for complying with new rules

By Peter Frost

[...] To promote the Oct. 1 debut of the exchanges, the online marketplaces where consumers can shop and buy insurance, Obama administration and Illinois officials touted the lower-than-expected monthly premiums that would make insurance more affordable for millions of Americans. But a Tribune analysis shows that 21 of the 22 lowest-priced plans offered on the Illinois health insurance exchange for Cook County have annual deductibles of more than $4,000 for an individual and $8,000 for family coverage.

Those deductibles, which represent the out-of-pocket money consumers must spend on health care before most insurance benefits kick in, are higher than what many consumers expected or may be able to stomach, benefit experts said.

By comparison, people who buy health insurance through their employer have an average individual deductible of just more than $1,100, according to the Kaiser Family Foundation.

Although millions of Americans will be eligible for federal assistance to help offset some of those costs, millions will not, underscoring one of the trade-offs wrought under the law's goal to ensure most people have access to health insurance.

"It's been major sticker shock for most of my clients and prospects," said Rich Fahn, president of the Northbrook-based insurance broker Excell Benefit Group. "I'm telling (clients) that everything they know historically about health plans has changed. They either have to pay more out-of-pocket or more premiums or both. It's an overwhelming concern."

Plans with the least expensive monthly premiums -- highlighted by state and federal officials as proof the new law will keep costs low for consumers -- have deductibles as high as $6,350 for individuals and $12,700 for families, the highest levels allowed under the law.

~~~~~~~~~~~~~~~~

Insurance brokers and health care experts also urge caution for consumers who choose plans with higher deductibles.

"Yes, rates are really low, but that's like saying, 'Here's a free car,' but if it costs you $500 a month to run, it's not really a free car," said Dave Stumm, executive vice president at Stumm Insurance, a Chicago-based brokerage.

Fahn calls the bronze plans "smoke-and-mirrors catastrophic plans," which don't provide benefits until and unless something bad happens -- a car wreck, a major surgery or a chronic illness.

For many low-income Americans, the law offers some help, though how much will vary by the individual.

The vast majority of the uninsured -- an estimated 80 to 90 percent, according to the Congressional Budget Office -- who buy coverage on the exchanges will qualify for federal subsidies in the form of tax credits. Those who make up to 400 percent of the federal poverty level (about $46,000 for an individual and $94,200 for a family of four) will be eligible for the subsidies to help offset the cost of premiums.

Further, people with incomes up to 250 percent of the federal poverty level (about $28,700 for an individual and $58,900 for a family of four) will qualify for cost-sharing subsidies that will reduce deductibles, in some cases substantially.

Brokers say they worry most about people who qualify for lower subsidies or none at all. Those with more modest incomes might not have enough in savings to pay for medical expenses.

They "could get slammed if they get sick," said Pollitz, of the Kaiser Family Foundation. "They just won't have the money. They just won't."

A potential consequence could be that some individuals may not seek medical care beyond routine office visits when they should, dissuaded by the specter of having to pay for it out of pocket.

"They'll just live without," Pollitz said, "kind of like they do now."

~~~~§§§~~~~

Obamacare opponents are having a great time pointing out higher rates for those high-deductible plans that have been growing in popularity as health care costs have skyrocketed. Those complaints fall on mostly sympathetic ears since most insured people, thankfully, don't face catastrophic bills. But the numbers that do are increasing -- those facing financial ruin in the aftermath of a horribly expensive medical events.

Sorry, folks. That's why it's called insurance, to insure you against those losses. It's a game of chance. You're betting you're gonna get sick or hurt and the insurance company is betting you won't.

Think of high deductible policies like life insurance. The only way to win is to lose.

Unfortunately those policies have for many the same appeal that those Mega-Millions interstate lottery drawings have. The difference, of course, is that "winning" in this case means facing possible financial ruin. And the sad part is that for many who have never before even had health insurance the bronze plans will be their choice because even with a federal subsidy that's still more than they can really afford. And those among them who do hit crippling medical bills will still get burned -- even with insurance.

Like the man said above, rates are really low, but that's like saying, 'Here's a free car,' but if it costs you $500 a month to run, it's not really a free car,"... the bronze plans [are] "smoke-and-mirrors catastrophic plans," which don't provide benefits until and unless something bad happens -- a car wreck, a major surgery or a chronic illness.

~~~~§§§~~~~

Junk Insurance is at the bottom of the barrel...

Changing subject somewhat (but not much) another group of so-called insurance plans will also vanish from the marketplace, a form of what many call "junk insurance" which attracts many (usually low-income) people by an unbelievably low premium. It's even worse than the "free car" illustration mentioned above.

Technical glitches of the Website have spawned a cottage industry of journalistic cheap shots and hit pieces which are red meat for Obamacare critics. Coupled with a rash of reports of premiums skyrocketing and endless loops of the president's widely-publicized promise that "if you like your present insurance plan, you can keep it" the story becomes low-hanging fruit for unprincipled reporters appealing to an ignorant and often equally unprincipled audience.

This article illustrates the point:

CBS News’ Misleading Obamacare Report: Woman’s Plan Paid $50 Per Service, Doesn’t Cover Hospitalization

On CBS This Morning, [Jan] Crawford reported that 56-year-old Dianne Barrette received a letter last month “from Blue Cross Blue Shield, informing her that as of January 2014, she would lose her current plan. She pays $54 a month. The new plan she’s being offered would run $591 a month, ten times more than what she currently pays.”

“What I have right now is what I’m happy with,” Barrette says in the report, “and I just want to know why I can’t keep what I have. Why do I have to be forced into something else.”

There are very good answers to her questions, answers which Crawford, either deliberately or through ignorance, failed to report, answers which are available to anyone with a passing familiarity with health insurance.

First of all, the plan that Barrette paid $54 a month for is barely health insurance at all. It’s part of a subset of insurance that Consumer Reports calls “junk health insurance” (and which even the company that sells it recommends that customers not rely solely upon) and it pays only $50 towards most of the services it covers. That’s it. If Dianne went to the doctor every week for a year, her plan would pay, at most, $2600. Meanwhile, based on average office visit charges, Diane would pay about $5,600.00. She probably doesn’t go to the doctor every week, of course, which means her plan pays a lot less, while her premium buys her a lot less. If she goes to the doctor, say, six times in a year, she’s paid a $648 premium for the privilege of spending another $600 on office visits. The plan also pays up to $15 per prescription, which will get you a few milligrams of most prescription drugs. The one decent deal on her plan is that it covers 100% of in-network lab services.

But many people just want the peace of mind to know that if something really bad happens, they won’t have to worry about being billed into the poorhouse. What if the worst happens, and Dianne needs to be hospitalized due to sudden illness or injury? Well, unless Dianne is suffering complications due to pregnancy, her plan covers nothing. If she’s having complications from pregnancy, it covers fifty bucks. It’s entirely possible that now-healthy Dianne is “happy” with this plan, but the whole idea behind the Affordable Care Act is that the rest of us are not happy having to pick up the tab if Dianne gets a disease, has an accident, or otherwise needs to go to the hospital. Frankly, though, Dianne would be better off saving that $648 and negotiating her office visits on her own.

The plan that Crawford compares Dianne’s junk insurance with (even BCBSFL recommends that customers not rely solely on GoBlue plans), on the other hand, is probably not the best deal available for the money if you’re planning fairly regular doctor visits, but it’s just one of many plans the company offers in that price range. It has a $6,250 deductible that applies to most services (the law requires routine care to be covered at 100%) before the plan pays. However, there’s a cheaper plan ($547/mo.) that covers the first 3 office visits per year at 100%, with a $40 copay after that. BCBSFL offers nine other plans cheaper than the one suggested in Dianne’s letter.

Like all Obamacare plans, of course, any plan Dianne chooses will have an out-of-pocket maximum of $6,350, versus the current $infinity that her plan offers.

Additionally, Crawford reports that Dianne “is eligible for some subsidies,” but “she has no idea what the subsidies would be because, of course, guess what, she can’t log on the website.”

Hey @foxnews, even you reported in 2010 that some folks would experience changes under #ACA. Why the shock now? 2010 http://t.co/SLsw8fZ04a

— David Shuster (@DavidShuster) October 29, 2013

Kaiser foundation: 1/2 of all getting health insurance cancellation notices will pay LESS for same coverage via exchanges. #ACA

— David Shuster (@DavidShuster) October 29, 2013

Monday Links -- October 28

Three dead' in Beijing's Tiananmen Square after car drives into crowd and explodes - Reuters http://t.co/pKtOC192YQ

— Paul Mooney 慕亦仁 (@pjmooney) October 28, 2013

Today's popular news may or may not cover this story well.

I'll be watching.

Police say Tiananmen Square will not reopen this afternoon - "massive activity" underway

— malcolmmoore (@MalcolmMoore) October 28, 2013

And in other news...

"She wld prefer not to receive instruction from country that caused collapse of global financial system in 1st place" pic.twitter.com/IbHNtw4PY6

— Gady Epstein (@gadyepstein) October 28, 2013

Israel names a new ambassador to Egypt. He'll start work just as soon as they figure out where to put the embassy: http://t.co/0qQuQtWyVC

— Gregg Carlstrom (@glcarlstrom) October 28, 2013

I reckon it'd be easier to make a list of people the NSA hasn't snooped on... Erm!? The Sentinelese people perhaps? http://t.co/sw8d2IJNLE

— Khaled Diab (@DiabolicalIdea) October 28, 2013

This begs the question: What *else* hasn't NSA told Obama about that he's now only finding out because of Snowden? http://t.co/bYRTPoPAtS

— Trevor Timm (@trevortimm) October 28, 2013

Don't skip this link.

Picking mushrooms is not for sissies.

mushroom pickers: probably the only folks in vancouver wishing for rain right now. my story in @thetyee http://t.co/EgrL6DNJWC

— sarah berman (@sarahberms) October 28, 2013

#BreakingNews women blown away by #ukstorm in London pic.twitter.com/lazJ8bghGj

— Anthony Shaw (@AnthonyShaw_) October 28, 2013

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

From the Facebook Timeline...

Posted on 10/28/2013 by Juan Cole

The revelation from the Snowden Papers that the National Security Agency had German Chancellor Angela Merkel’s personal cell phone under surveillance has produced a central fallout. Dueling leaks over the international embarrassment have forced the White House to a key admission: President Barack Obama did not know what the NSA was up to.

Ever since the Snowden revelations of the massive, world-girdling extent of NSA electronic surveillance surfaced, I have been wondering two things: Did they tell Obama about it when they took office in 2009? And, do they have something on Obama?

[...] The White House then leaked on Sunday that the Snowden revelations provoked a review of NSA programs and procedures, and the fact that the NSA had Merkel’s and 35 other world leaders’ personal phones under surveillance was revealed to the White House. Someone there then ordered this summer that the personal spying on Merkel and “some” other leaders be halted (the halt wasn’t ordered on all 35?).

In attempting to repair Obama’s reputation with his colleagues at the G-20, however, the White House counter-leakers have made an epochal and very serious revelation: The President wasn’t in the know. (Even in the best case scenario that he was told in 2010, he wasn’t in the know for the first 18 months of his presidency!)

Edward Snowden’s critics have alleged that he revealed classified US secrets to the enemies of the US. But it seems increasingly likely that he revealed them to . . . Barack Obama.

If so, imagine how furious Obama is behind the scenes. It is not his style to act out in public. But the sudden announcements of the retirement of NSA chief Keith Alexander (who apparently should be in jail) and of Director of National Intelligence James Clapper (who certainly should be in jail for lying to Congress) likely signal that Obama demanded they leave.

All of these revelations are being treated as bureaucratic infighting by the inside-the-Beltway courtier press.

It doesn’t seem to occur to anyone to ask what the implications are that an occult intelligence bureaucracy funded at $52 billion a year by your and my tax dollars keeps our elected leaders in the dark about its activities.

- [...] How much of our society and politics are shaped by selective leaks about individuals gained from this surveillance?

- Did the 2008 Wall Street Crash occur in part because the Bush administration had removed pro-regulation New York Governor Elliot Spitzer, using information gathered from his bank accounts, cell phone and personal computer?

- How many Iraq War critics were, like myself, targeted for surveillance?

- How many seemingly minor scandals that force decision-makers from office are actually a conspiracy of shadowy intelligence operatives?

- How many of the vocal defenders of the NSA, or of those politicians too timid to demand reform, fear revelation of personal secrets?

- Do we have a government or a Mafia extortion racket?

These questions may seem outlandish, but they are evidence of the corrosive impact of covert government on a Republic. One can never know what politics is legitimate and what is the result of manipulation. NSA denials that they are using this material gathered on US citizens are not very credible given their officials’ repeated lies and also given their hiding of their activities from the President of the United States.Juan Cole is no conspiracy nut.

He is a non-partisan academic.

He raises some very good questions.

And he's been doing it for years.

~~~~§§§~~~~

.@cbabington on the bad shape the GOP is in http://t.co/j223EpDcEf

— Greg Dworkin (@DemFromCT) October 28, 2013

Two states are setting up a bogus voter registration system that could disenfranchise thousands of voters http://t.co/F2LnN2jfrHAccording to a 2006 study by the Brennan Center for Justice, at least seven percent of eligible voters “do not have ready access to the documents needed to prove citizenship.” The Supreme Court affirmed the lower court ruling, finding that states like Arizona could not reject applicants who registered using the NVRA form.

— BillMoyers.com (@BillMoyersHQ) October 28, 2013

Now Arizona and Kansas — which passed a similar proof-of-citizenship law in 2011 — are arguing that the Supreme Court’s decision applies only to federal elections and that those who register using the federal form cannot vote in state and local elections. The two states have sued the Election Assistance Commission and are setting up a two-tiered system of voter registration, which could disenfranchise thousands of voters and infringe on state and federal law.

The tactics of Arizona and Kansas recall the days of segregation and the Supreme Court’s 1896 “separate but equal” ruling in Plessy v. Ferguson. “These dual registration systems have a really ugly racial history,” says Dale Ho, director of the ACLU’s Voting Rights Project. “They were set up after Reconstruction alongside poll taxes, literacy tests and all the other devices that were used to disenfranchise African-American voters.”

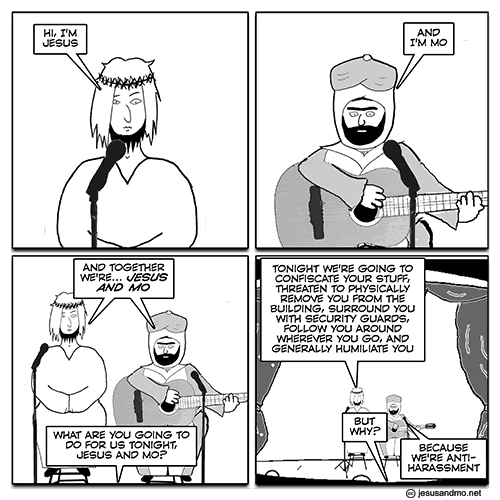

Jesus & Mo cartoon on the LSE student union thought police http://t.co/9K8dIbilNs ah, UK student unions, the hotbeds of conformism

— Karl Sharro (@KarlreMarks) October 28, 2013

This is worth reading: @ggreenwald talks to Bill Keller http://t.co/1WxXkgFVfq (via @ron_fournier @JohnJHarwood)Worth reading, indeed. This colloquy between two top-tier journalists makes really good reading for anyone interested in the subject. I'm not particularly interested, being more attracted to facts than spin. But I deeply appreciate the power of spin and the effect it has on outcomes. (I almost said "democratic" outcomes until I realized the even more devastating impact spin can have on extremists -- whether they be suicide bombers, or those who send them, or duly elected representatives to the US House or those who organized the districts sending them.)

— Peter Daou (@peterdaou) October 28, 2013

Excerpt here:

Dear Bill,

There’s no question that journalists at establishment media venues, certainly including The New York Times, have produced some superb reporting over the last couple of decades. I don’t think anyone contends that what has become (rather recently) the standard model for a reporter — concealing one’s subjective perspectives or what appears to be “opinions” — precludes good journalism.

But this model has also produced lots of atrocious journalism and some toxic habits that are weakening the profession. A journalist who is petrified of appearing to express any opinions will often steer clear of declarative sentences about what is true, opting instead for a cowardly and unhelpful “here’s-what-both-sides-say-and-I-won’t-resolve-the-conflicts” formulation. That rewards dishonesty on the part of political and corporate officials who know they can rely on “objective” reporters to amplify their falsehoods without challenge (i.e., reporting is reduced to “X says Y” rather than “X says Y and that’s false”).

Worse still, this suffocating constraint on how reporters are permitted to express themselves produces a self-neutering form of journalism that becomes as ineffectual as it is boring. A failure to call torture “torture” because government officials demand that a more pleasant euphemism be used, or lazily equating a demonstrably true assertion with a demonstrably false one, drains journalism of its passion, vibrancy, vitality and soul.

Worst of all, this model rests on a false conceit. Human beings are not objectivity-driven machines. We all intrinsically perceive and process the world through subjective prisms. What is the value in pretending otherwise?

The relevant distinction is not between journalists who have opinions and those who do not, because the latter category is mythical. The relevant distinction is between journalists who honestly disclose their subjective assumptions and political values and those who dishonestly pretend they have none or conceal them from their readers.

Sunday, October 27, 2013

Elizabeth Warren and Jon Stewart -- April, 2009

This snip from The Daily Show is now four and a half years old.

It's time to watch it again, taking another look at the long view.

This woman is brilliant. It's no wonder she's being mentioned as presidential material for 2016.

I was looking for something else this morning when I came across a post from my old blog that I had forgotten. Forgive me for naked self-promotion, but after four years what I said then still looks good to me. Here it is in toto, ending with that video.

A Layman's Look at Economics

Blogged by John Ballard, April, 2009

I heard it again this morning, a brief reference in a radio report to the "real economy." It is tucked in an obscure story about the economics of "developing nations," the proletarian footnotes in the global financial meltdown. A point was being made that the economies of countries in the developing world (that's what we call today's equivalent of colonial holdings) lack the depth and sophistication of the world' bigger economic engines, the global financial meltdown threatens to harm their REAL economies, which has measurable impact on the global economy. Those "real" economies are distinct from their respective FINANCIAL SECTORS. In other words, the financial sectors can do all kinds of tricks with money, credit and the like, but real value derives not from crunching and tumbling numbers on paper, but from actual work and production by real people going to real jobs producing actual goods and services being paid for by real customers contributing to actual profits which reward the original producers of those goods and services.

This is not rocket science. I don't know how many different ways to state it, but this economic sinkhole has been recognized from pre-history. The sacred texts of most of the world's faiths refer to an economic abuse quaintly referred to as usury. The term has a number of different definitions, all of which are meant to draw a line between good lending and bad lending, but no matter whose definition you choose, good lending usually means that which I do and bad lending means what I am not permitted to do, although I would love to be getting a better return doing the same thing.

Here is a great line from Judge Posner I came across this morning.

I heard it again this morning, a brief reference in a radio report to the "real economy." It is tucked in an obscure story about the economics of "developing nations," the proletarian footnotes in the global financial meltdown. A point was being made that the economies of countries in the developing world (that's what we call today's equivalent of colonial holdings) lack the depth and sophistication of the world' bigger economic engines, the global financial meltdown threatens to harm their REAL economies, which has measurable impact on the global economy. Those "real" economies are distinct from their respective FINANCIAL SECTORS. In other words, the financial sectors can do all kinds of tricks with money, credit and the like, but real value derives not from crunching and tumbling numbers on paper, but from actual work and production by real people going to real jobs producing actual goods and services being paid for by real customers contributing to actual profits which reward the original producers of those goods and services.

This is not rocket science. I don't know how many different ways to state it, but this economic sinkhole has been recognized from pre-history. The sacred texts of most of the world's faiths refer to an economic abuse quaintly referred to as usury. The term has a number of different definitions, all of which are meant to draw a line between good lending and bad lending, but no matter whose definition you choose, good lending usually means that which I do and bad lending means what I am not permitted to do, although I would love to be getting a better return doing the same thing.

Here is a great line from Judge Posner I came across this morning.

If you’re worried that lions are eating too many zebras, you don’t say to the lions, "You’re eating too many zebras." You have to build a fence around the lions. They’re not going to build it.

That's from Americans for Fairness in Lending (AFFIL). I don't know anything about it, but they seem to have their head on straight.

My time is more limited this morning than my already tiny influence, so rather than drone on to make myself feel better, here are some links that taken together make for a good rant. Today's economic meltdown didn't sprout into being last year. (It is the global economic equivalent of the "dead zones" now blooming at the ends of most of the world's rivers as they dump various toxic blends of chemicals into the world's oceans. The chemicals, remember, are all generated with the best of good intentions, in some cases preventing starvation and/or disease among many of God's children. Unfortunately, when allowed to drain into rivers which deliver them into oceans, the effect is that large and growing sections of those oceans become uninhabitable by the seal life that once flourished there. Yesterday was Earth Day and this is my little recognition of that fashionable observance. Something like an obscure jouornalist's reference to "real economies." Sadly, way under most radars.)

Four years ago when the Social Security System was under discussion and smart people in Washington were seriously contemplating what they called privatizing the system, I put up a rant pointing out the difference between SOCIAL security ann INDIVIDUAL security. No one seems to know the difference. This was part of that rant...

With carve-out individual accounts, we erode social protections at a time when we also seem to be witnessing the collapse of the corporate defined-benefit pension system. If we go to a retirement system that is entirely individual accounts, we also lose opportunities for income redistribution. [quote from Will Wilkerson. See link for context.]Two comments.

First, anytime the phrase "income redistribution" is used out loud, in public or in print, with no sense of shame or apology, I know that the person using it may as well be advocating Communism. I have been labeled Socialist and worse myself, so we'll just have to let the matter pass without further comment on my part. I have no interest in debating the phrase, but I want plainly to admit that I recognize the inflammatory effect that the phrase has on a good many people. People who have no problem with large estates being passed to heirs who never hit a lick at a snake in their life but thanks to an accident of birth can enjoy a lifetime of self-indulgence if they choose. "Income redistribution" in that instance takes the form of pissing it all away.

Second, a more important point about "the collapse of the corporate defined-benefit pension system" that he mentioned.

The Pension Benefits Guaranty Corporation did not just blossom into existence because a lot of politicians in Washington had a fit of generosity one session and decided to do something nice for folks. It was a political response to thousands of employees losing retirement benefits because the outfits for whom they worked went out of business with no safety net for those liabilities. It didn't happen because of the depression, by the way. It happened decades later when that great American economic engine we call Free Enterprise had plenty of time to prevent and protect against disasters like "How can we protect our people in case we go out of business?"

If memory serves, I think that a lot of companies didn't even officially "go out of business." There was an era of mergers and acquisitions, hostile takeovers and the like that also contributed to the problem, with a lot of "private" pension benefits' being leveraged out of existence or liquidated outright, also resulting in pensions evaporating before the eyes of people whose only remaining pinch of the economy became their Social Security income.

When the market crashed last September my first reaction was a flashback to this post: Where would the country be now if part of the Social Security System (ersatz) money were linked to securities?

Considering the wounds and scar tissue done to private plans that will not recover until inflation has gutted their respective losses, the question still gives me cold chills.

In September, 2004, my rant on Outsourcing which mentioned mergers and acquisitions seems now to have been prescient. If you go to this link, let the reference to the "real economy" mentioned at the start of this post ring quietly in the background.

It's not fashionable to ask where profits come from, however. It's like asking if someone has had cosmetic surgery or was fortunate enough to come into a lot of money following the recent death of a loved one. We want the dealership from which we get our car to be profitable enough to keep up with the warranty service, but we don't want any profit to that dealer from our purchase, and we sure as hell don't want to pay dealer prices for service. Profit is what happens when a company makes a good deal with someone else. When I have to make the same deal, however, they are taking advantage of me.

Not everyone thinks like this, of course. There are lots of people who cheerfully pay a dear price to be the first or latest in their peer group to see a movie or own a certain fashion or travel to some wonderful destination. Big tips, ostentatiously bigger than the norm, are sometimes found by delighted service people who don't care that they say more about the ego needs of patrons than the quality of their service. And I think there are a few people who take a balanced view of profits and don't get disturbed about their contributions to someone else's profit.

In the face of all this resistance on the part of customers, clients and patrons to cut them out of reasonable profits businesses are forced to be imaginative about being able to report ever higher profits. The word "bubble" comes to mind first, because that is the easiest track to profits in the short term. We have seen it many times, from the famous tulip bulbs to the California Gold Rush to the explosion of dotcoms. In the end the bubble bursts (hence the term) but there are what I would call "serial bubbles" (see "serial monogamy") in real estate, fashions, entertainment and advertising. I heard a couple of weeks ago that insurance stock prices go up when a hurricane hits because historically that is when premiums go up, not only to cover "losses" due to weather, but improved profits as well. Why do insurance companies jack up the prices at just the time that their policy holders can least afford to pay more? Because they can.

A few years ago, and to some extent continuing today, the phenomenon of "mergers and acquisitions" yielded breathtaking "profits". When two companies in the same line of work merge it is a win-win situation (except for the people whose jobs are sacrificed for the deal) because the new, stronger company has one less competitor in the marketplace (whew!) as well as a more efficient operation, because the payroll departments, accountants, ad agencies and other support operations can be performed by one department instead of two. All this improved efficiency translates into profits.

Speaking of accounting, now there is the toolbox from which a lot of profits can be made to flow. When they get the cooperation they need from operations there is practically no end to the profits that can result. Just ask the people at Enron how easy it can be.

Have you noticed that so far that nothing has been mentioned about productivity? That is my point. The only real source of profits has to be that something has been produced. Moving the furniture around does not produce anything, unless you are paid to be an interior decorator. Mergers might squeeze a few cents from the economy of scale, but they real improvements, if you can call them that, is that there is more to report for profits because fewer people are being paid.

The post was about outsourcing, but you get the idea.

Come to think of it, outsourcing is nothing more than a miniature version of a merger/acquisition.

Saturday, October 26, 2013

The President's Devotional

One of the most moving things I've ever read. Great credit to @BarackObama > http://t.co/qTcBVioHAHI knew this was coming. A few days ago I already saw a hit piece aimed at twisting this little book in a way to discredit him. But this endorsement by Piers Morgan is very powerful. Of course the endorsement of Piers Morgan is something of a kiss of death for anyone, but we are living in a time when the kiss of death is part of the artillery in the political battlefield.

— Piers Morgan (@piersmorgan) October 26, 2013

Frankly, I don't give a damn if someone is being polite sincerely or pretending to be polite by going through the motions. I dealt too many years with the public to know the difference. But I learned along the way to the person pretending to be nice is a helluva lot easier to get along with than someone behaving like a complete ass. When it comes to human relations -- especially in politics and diplomacy -- I'll take pretending any day of the week over so-called "honesty" that has no aim other than to question someone's character. The same goes for expressions of sympathy following a great loss. Sorry for my negative remarks, but this has been grating on me and I needed to get it out of my system.

~~~~~~~~~~~~~~~~~~~~~~~~~

By Joshua Dubois

The White House is not supposed to be a place for brokenness. Sheer, shattered, brokenness. But that’s what we experienced on the weekend of December 14, 2012.

I was sitting at my desk around midday on Friday the 14th when I saw the images flash on CNN: A school. A gunman. Children fleeing, crying.

It’s sad that we’ve grown so accustomed to these types of scenes that my first thought was I hope there are no deaths, just injuries. I thought, Maybe it’s your run-of-the-mill scare.

And then the news from Sandy Hook Elementary School, a small school in the tiny hamlet of Newtown, Connecticut, began pouring in. The public details were horrific enough: Twenty children murdered. Six staff. Parents searching a gymnasium for signs of their kids.

But the private facts we received in the White House from the FBI were even worse.

How the gunman treated the children like criminals, lining them up to shoot them down. How so many bullets penetrated them that many were left unrecognizable. How the killer went from one classroom to another and would have gone farther if his rifle would’ve let him.

That news began a weekend of prayer and numbness, which I awoke from on Saturday only to receive the word that the president would like me to accompany him to Newtown. He wanted to meet with the families of the victims and then offer words of comfort to the country at an interfaith memorial service.

I left early to help the advance team—the hardworking folks who handle logistics for every event—set things up, and I arrived at the local high school where the meetings and memorial service would take place. We prepared seven or eight classrooms for the families of the slain children and teachers, two or three families to a classroom, placing water and tissues and snacks in each one. Honestly, we didn’t know how to prepare; it was the best we could think of.

The families came in and gathered together, room by room. Many struggled to offer a weak smile when we whispered, “The president will be here soon.” A few were visibly angry—so understandable that it barely needs to be said—and were looking for someone, anyone, to blame. Mostly they sat in silence.

I went downstairs to greet President Obama when he arrived, and I provided an overview of the situation. “Two families per classroom . . . The first is . . . and their child was . . . The second is . . . and their child was . . . We’ll tell you the rest as you go.”

The president took a deep breath and steeled himself, and went into the first classroom. And what happened next I’ll never forget.

Person after person received an engulfing hug from our commander in chief. He’d say, “Tell me about your son. . . . Tell me about your daughter,” and then hold pictures of the lost beloved as their parents described favorite foods, television shows, and the sound of their laughter. For the younger siblings of those who had passed away—many of them two, three, or four years old, too young to understand it all—the president would grab them and toss them, laughing, up into the air, and then hand them a box of White House M&M’s, which were always kept close at hand. In each room, I saw his eyes water, but he did not break.

And then the entire scene would repeat—for hours. Over and over and over again, through well over a hundred relatives of the fallen, each one equally broken, wrecked by the loss. After each classroom, we would go back into those fluorescent hallways and walk through the names of the coming families, and then the president would dive back in, like a soldier returning to a tour of duty in a worthy but wearing war. We spent what felt like a lifetime in those classrooms, and every single person received the same tender treatment. The same hugs. The same looks, directly in their eyes. The same sincere offer of support and prayer.

The staff did the preparation work, but the comfort and healing were all on President Obama. I remember worrying about the toll it was taking on him. And of course, even a president’s comfort was woefully inadequate for these families in the face of this particularly unspeakable loss. But it became some small measure of love, on a weekend when evil reigned.

And the funny thing is—President Obama has never spoken about these meetings. Yes, he addressed the shooting in Newtown and gun violence in general in a subsequent speech, but he did not speak of those private gatherings. In fact, he was nearly silent on Air Force One as we rode back to Washington, and has said very little about his time with these families since. It must have been one of the defining moments of his presidency, quiet hours in solemn classrooms, extending as much healing as was in his power to extend. But he kept it to himself—never seeking to teach a lesson based on those mournful conversations, or opening them up to public view.

Jesus teaches us that some things—the holiest things, the most painful and important and cherished things—we are to do in secret. Not for public consumption and display, but as acts of service to others, and worship to God. For then, “your Father, who sees what is done in secret, will reward you,” perhaps not now, but certainly in eternity. We learned many lessons in Newtown that day; this is one I’ve kept closely at heart.

Saturday Links -- October 26

This is the brilliant man performing the No Woman No Drive video: @HishamFageeh Hisham, you win the internet today. http://t.co/MPSfLkPMZ3

— Karl Sharro (@KarlreMarks) October 26, 2013

Saudi Arabia women defy authorities over female driving ban http://t.co/JOm2ecF1rQ

— Hafed Al Ghwell (@HafedAlGhwell) October 26, 2013

.@auerbachkeller, a software engineer, has the best piece I've seen on how http://t.co/61fg9MYvbi went wrong http://t.co/QqhZj0lzWe

— Atul Gawande (@Atul_Gawande) October 26, 2013

|

From left to right, CGI Federal's Cheryl Campbell, Optum/QSSI's Andrew Slavitt, Equifax Workforce Solutions' Lynn Spellecy, and Serco's John Lau are sworn in during a hearing on implementation of the Affordable Care Act before the House Energy and Commerce Committee on Oct. 24, 2013.

But if you place these kinds of managers on the critical communication chain of a software project, you immediately endanger its success. Project quality is sacrificed for the sake of appearances—meeting the letter of the contract with indifference toward the actual practical outcome. Even if you put “the best and the brightest” (to borrow the administration’s own phrase) on a project, the mere presence of such managers can make it impossible to do good work, because the lines of communication will be broken.

==► Go to the link for the gory details.

and @brianrahmer as any big website progammer can tell Prof. K, "kludge" doesn't work & public OPTION was feasible http://t.co/MIoU59Kja6

Krugman's column is good. He points out how the two government-sponsored models we already have -- Medicare and Social Security -- are uncomplicated and well-run.

~~~~§§§~~~~

Last night I was surfing in the middle of the night and came across

the great genius cartoons of Barry Deutsch.

|

This reality camouflaged by govt "job numbers" / McDonald's advises employee to apply for food stamps via @AJAM http://t.co/jHImrith0n

— Tony Karon (@TonyKaron) October 25, 2013

The burgeoning battle between fast-food workers and their employers over low wages and benefits was ratcheted up a notch, this week, with the leak of a phone conversation from a McDonald’s employee helpline in which a longtime employee was advised to go on food stamps in order to make ends meet.

Fast-food employee advocacy group Low Pay Is Not OK posted a video on its website on Wednesday featuring a recording of a phone call made by McDonald’s employee Nancy Salgado to McResource, a phone line for McDonald’s employees to call for information about housing, child care and other resources.

This is why we cannot wait any longer to pass comprehensive immigration reform. The #timeisnow: pic.twitter.com/RQnf6o5Qec

— Nancy Pelosi (@NancyPelosi) October 25, 2013

Friday, October 25, 2013

Government Surveillance -- "Roving Bug" Has Been Around For Years

Again we are shocked -- shocked, I tell you -- that the gubmint is looking over our shoulder.

Just for grins, here is another old blog post about an FBI surveillance technique every bit as intrusive as the current high-profile story about phone records.

Note the date -- 2006.

I reposted this in June, 2013 and now again in October.

==►December 02, 2006

The FBI's "Roving Bug"

Just for grins, here is another old blog post about an FBI surveillance technique every bit as intrusive as the current high-profile story about phone records.

Note the date -- 2006.

I reposted this in June, 2013 and now again in October.

~~~~§§§~~~~

The FBI's "Roving Bug"

Surveillance is getting smaller and more sneaky all the time. If I understand this article correctly, a cell phone can be converted into a listening device without the owner's knowledge, even without anyone touching the instrument at all. According to the article, "the FBI [is] able to surreptitiously turn on the built-in microphones in automotive systems like General Motors' OnStar to snoop on passengers' conversations." This is not news. The technology has been around for three or four years.

The U.S. Commerce Department's security office warns that "a cellular telephone can be turned into a microphone and transmitter for the purpose of listening to conversations in the vicinity of the phone." An article in the Financial Times last year said mobile providers can "remotely install a piece of software on to any handset, without the owner's knowledge, which will activate the microphone even when its owner is not making a call."

Nextel and Samsung handsets and the Motorola Razr are especially vulnerable to software downloads that activate their microphones, said James Atkinson, a counter-surveillance consultant who has worked closely with government agencies. "They can be remotely accessed and made to transmit room audio all the time," he said. "You can do that without having physical access to the phone."

Because modern handsets are miniature computers, downloaded software could modify the usual interface that always displays when a call is in progress. The spyware could then place a call to the FBI and activate the microphone--all without the owner knowing it happened. (The FBI declined to comment on Friday.)

"If a phone has in fact been modified to act as a bug, the only way to counteract that is to either have a bugsweeper follow you around 24-7, which is not practical, or to peel the battery off the phone," Atkinson said. Security-conscious corporate executives routinely remove the batteries from their cell phones, he added.

H/T John Robb

Posted by Hoots at 5:28 PM

3 comments:

Patti said...

How do I get want one of these?

The U.S. Commerce Department's security office warns that "a cellular telephone can be turned into a microphone and transmitter for the purpose of listening to conversations in the vicinity of the phone." An article in the Financial Times last year said mobile providers can "remotely install a piece of software on to any handset, without the owner's knowledge, which will activate the microphone even when its owner is not making a call."

Nextel and Samsung handsets and the Motorola Razr are especially vulnerable to software downloads that activate their microphones, said James Atkinson, a counter-surveillance consultant who has worked closely with government agencies. "They can be remotely accessed and made to transmit room audio all the time," he said. "You can do that without having physical access to the phone."

Because modern handsets are miniature computers, downloaded software could modify the usual interface that always displays when a call is in progress. The spyware could then place a call to the FBI and activate the microphone--all without the owner knowing it happened. (The FBI declined to comment on Friday.)

"If a phone has in fact been modified to act as a bug, the only way to counteract that is to either have a bugsweeper follow you around 24-7, which is not practical, or to peel the battery off the phone," Atkinson said. Security-conscious corporate executives routinely remove the batteries from their cell phones, he added.

H/T John Robb

Posted by Hoots at 5:28 PM

3 comments:

Patti said...

How do I get want one of these?

Hoots said...

Contact the FBI and tell them you want one. I'm sure they'll be interested. Tell 'em Hoots sent you.

Contact the FBI and tell them you want one. I'm sure they'll be interested. Tell 'em Hoots sent you.

Anonymous said...

:D nice one Hoots !

Thursday, October 24, 2013

Links and Messages -- October 24

Turkey sending $850,000 in aid to Gaza to help with energy needs http://t.co/QffPk5aygk

— joseph dana (@ibnezra) October 24, 2013

FP author tells Saudi Arabia to go pound sand http://t.co/bNG9YsNacXSaudi Arabia wants a very different Middle East than we do. The Saudis oppose democracy. They oppose freedom of the press. They oppose freedom of conscience and practice of faiths other than Islam. They oppose women's equality before the law. They oppose the idea that individuals have rights and loan them in limited ways and for limited purposes to governments. They deny rights to their own Shiite citizens in Saudi Arabia, while advocating and enforcing the same in Bahrain. They denigrate domestic opposition as solely agents of Iran.

— Blake Hounshell (@blakehounshell) October 24, 2013

Not only do the Saudis oppose these fundamental values of American society, but they have funded and armed some of the most virulent jihadists. Rachel Bronson's superb history of U.S.-Saudi relations, Thicker Than Oil, makes clear that the United States was complicit in Saudi Arabia's fostering of the mujahideen in Afghanistan; the Saudis now want U.S. complicity in supporting jihadists in Syria and the return to power of the deep state in Egypt (a model they would perpetuate throughout the region).

US says very concerned about Turkey's Chinese missile deal http://t.co/8XQjIPQsC6Turkey has said it is likely to sign the $3.4 billion missile defence deal with CPMIEC but that its decision is not yet final. Some defence analysts had expected the contract to go to US company Raytheon Co or the Franco-Italian Eurosam SAMP/T.

— Mehmet Solmaz (@MhmtSlmz) October 24, 2013

Diplomats say buying a system that does not work with NATO systems would hamper the ability of NATO allies to work together, undermining a principle of the 28-nation alliance.

[US ambassador] Ricciardone also said it is a “privilege” to work with Turkey's spy chief, who has come under the spotlight in the past week, adding that Hakan Fidan is loyal to his government.

~~~~§§§~~~~

I just love how insightful American readers are.

Thanks to Conservative echo-chambers

they catch every policy nuance.

first Benghazi, and now this. Shameful... pic.twitter.com/mARxYhaJdv

— lawblob (@lawblob) October 24, 2013

Ouch. Headline in Politico: "Heckuva job, Sebelius" http://t.co/9deOxZOv3a

— David Wessel (@davidmwessel) October 24, 2013

RT @BaFana3: LOL! New term coined today by Yemeni press for #Yemen's Minister of Electricity: the Prince of Darkness. pic.twitter.com/AHQxGARaEQ

— Iona Craig إيونـا (@ionacraig) October 24, 2013

So three EU commissioners walk into a bar. The punchline is utterly incomprehensible but available in 24 languages.

— Karl Sharro (@KarlreMarks) October 24, 2013

The U.S.-Saudi crackup reaches a dramatic tipping point --> http://t.co/76XlH6ZjgV ( @Akhbar)Saudi King Abdullah privately voiced his frustration with U.S. policy in a lunch in Riyadh Monday with King Abdullah of Jordan and Crown Prince Mohammed bin Zayed of the U.A.E., according to a knowledgeable Arab official. The Saudi monarch “is convinced the U.S. is unreliable,” this official said. “I don’t see a genuine desire to fix it” on either side, he added.

— Jenan Moussa (@jenanmoussa) October 24, 2013

The Saudis’ pique, in turn, has reinforced the White House’s frustration that Riyadh is an ungrateful and sometimes petulant ally. When Secretary of State John Kerry was in the region a few weeks ago, he asked to visit Bandar. The Saudi prince is said to have responded that he was on his way out of the kingdom, but that Kerry could meet him at the airport. This response struck U.S. officials as high-handed.

Saudi Arabia obviously wants attention, but what’s surprising is the White House’s inability to convey the desired reassurances over the past two years. The problem was clear in the fall of 2011, when I was told by Saudi officials in Riyadh that they increasingly regarded the U.S. as unreliable and would look elsewhere for their security. Obama’s reaction to these reports was to be peeved that the Saudis didn’t recognize all that the U.S. was doing to help their security, behind the scenes. The president was right on the facts but wrong on the atmospherics.

Tuesday, October 22, 2013

HCR -- Reading Links -- PPACA and Exchanges

While the media on all sides continue yammering away about glitches in the ACA Exchange, there is plenty of background reading to do. What we are witnessing now is just the second act in a drama with at least three, four or more acts. It's too soon to predict how long it will last, but here is my take on the whole picture. Reading links follow. Act One starts right after World War Two when the Blues were created. (Blue Cross/ Blue Shield)

►Accountable Care Organizations (ACO)

Critics continue to claim Obama made a 'sweet deal' with carriers, but Wall Street says for-profit insurers won't 'make out like bandits'

Some insurers pulled out of the exchanges required by the Affordable Care Act as the Oct. 1 launch approached, leaving an uneven patchwork of providers.

Comments and questions are welcome. I'm not interested in arguing with anyone wanting to complain but I am happy to explore questions that need to be answered. Many may still not have answers but I have time to search, and I know a few resourceful people who also know where to look.

Addendum, October, 2015

I have used the following scenario often as copy/paste comment to discussions.

- Act One -- The Trainwreck

Scene One opens with the creation of employer-sponsored group insurance to help employees share the costs of hospital charges. Physicians hated the idea, fearing that if hospitals became too important to health care they would be in competition with private practices, and in the aftermath of the war they feared the idea of cost controls. The political compromise was that all hospitals had to be made non-profit. Blue Cross was enacted.

Scene Two finds the doctors discovering how group insurance enabled hospitals (a resource without which they could not work) to pay their bills more smoothly, so they opened the way for another kind of group insurance for "medical services" not provided by hospitals. Blue Shield was created.

Scene Three takes place in the Sixties when someone discovered that for-profit hospitals could be for health care what McDonald's was to hamburgers. By then it didn't take long to get past those old non-profit notions.

Scene Four sees medical costs getting out of hand. Too many people are demanding too much attention from too many specialties and too many drugs are hitting the market with too many marketing schemes and the insurance industry is growing like a Ponzi scheme. But industry professionals saw the handwriting on the wall. HMO's and PPO's were created.

Scene Five -- Everybody hates HMOs so much that the tax laws had to be adjusted so that all medical premiums (which once were part of every taxpayer's itemized deductions with virtually no limit) were capped for individuals but made "pre-tax" on employer "flex-plans" while every dime of medical costs became a business expense for the employer, and "self-insured" became the order of the day.

Everybody with insurance was happy. As long as insured people paid deductibles and copays they were like all-you-can-eat patrons at a buffet. The actual costs were no longer of any importance to the people seeking health care. All they cared about was getting plenty of bang for their buck. Companies didn't complain, since health insurance costs were just another journal entry on the balance sheets, and after COBRA came along, anyone who thought about leaving a job was terrified at the prospect of losing all their income at the same moment that their health care premiums doubled (or more). And as "benefits" don't begin until after a probationary period company health insurance became the golden handcuffs.

Job lock was now firmly established. Medical costs were growing faster than the country's GDP could sustain. Small companies bunched together for group insurance, but many individuals and companies had to resort to high-deductible plans for catastrophic coverage and all other medical expenses had to be paid until then. MSAs and HSAs were tossed out like MREs to a starving regiment. And to make matters worse, millions of people not fortunate enough to be with one of the companies with health insurance were not insured at all. There was more. Much more. But the total picture was one of the train wreck which was Act One. - Act Two -- The Salvage Operation

Scene One takes place following the presidential election of 2008. Previous administrations had been trying with no success to slow down the speeding train. Both political parties had given it their best shot and failed, mainly because the insurance, health care, and drug companies were making so much money they didn't see any need to put on the brakes. A handful of technocrats and policy wonks knew better, and a growing number of Congressional staff and research specialists were getting alarmed. A critical mass of many people from many quarters finally concludes "We are all in the same boat and the boat is gonna sink if we don't do something to stop the costs."

Scene Two is two years long. A historic political, professional, multi-faceted Congressional tug-o-war takes place which ends with a reconciliation between the Senate and the House of Representatives called the Patient Protection and Affordable Care Act. There was a lot of yelling and screaming because the final legislation was the result of "reconciliation" but most people forgot that is how most stuck laws get passed, including the Consolidated Omnibus Budget and Reconciliation Act of 1985. (COBRA)

Scene Three is a political whiplash from opponents of the new law. Many people hated it, including health care professionals. Few took time to examine the details and most who did were looking for weaknesses rather than strengths, in much the same way that sports coaches study opponents to locate vulnerable spots. The CLASS Act portion was abandoned almost overnight. So the challenge of what to do about the costs of long-term care will have to wait for some yet to be determined time in the future. - Act Three -- The Launch of PPACA

The launch of PPACA is spread out over eight years.

Scene One was an official celebration and presidential signing ceremony followed by a few of the least costly features -- allowing students to remain on their parents' policy til the age of 26, certain free well-care visits and screening, free contraceptives for women, and others. Almost overnight screams of religious persecution and other objections captured the headlines as powerful people in high places, political and religious alike, mounted the bandwagon.

Scene Two involved a raft of legal challenges, including historic Supreme Court decisions which validated the overall legislation while allowing states to opt out of the Medicaid portion, thus allowing several million uninsured poor Americans to continue living without affordable health insurance.

Scene Three was a protracted effort on the part of a minority of about thirty die-hard opponents in the House of Representatives to "defund or repeal Obamacare." They successfully passed two or three dozen bills along those lines in the House of Representatives, knowing that none of them had a chance of passing the Senate, and all of which would have been vetoed by the president had any slipped through. Scene Three ended with a partial government shutdown coupled with a threat to cap the nation's debt limit which was averted in the final hours.

Scene Four, now in progress, was the opening of the Exchanges on October 1, three weeks ago. Out of fifty states, several are running smoothly, a few are still working out the kinks and the federally run exchanges, operating in those states which opted not to construct their own, has been thus far a technically flawed mess. Naturally the most complaints are coming from those places that might have done the job themselves, but that would have spoiled the game for opponents who never miss a chance to throw rotten eggs and other garbage at the stage.

Massachusetts, a model for the whole country, had already insured over ninety-five percent of it's citizens, thanks to what they call Romney-Care after the Republican candidate for the 2012 election, who was governor at the time that state put universal health care into place. - Act Four -- Trials and Errors

It's too soon to know what the remaining acts will look like or how many their might be. The Launch will not be officially completed until 2018 when a tax on "Cadillac" policies is scheduled to be officially in place. Between now and then there will be numerous attacks, adjustments, delays and modifications as with any new program. As we have learned by declaring war the future is not at all what we imagine it should be. In addition to actual wars in Iraq and Afghanistan, both of which are still in progress (Yes, Virginia, when tens of thousands are killed after we have officially left, that war is still in progress.) we speak carelessly of wars on cancer and drugs, not to mention the War on Terror. - Act Five -- Adjusting to a New ParadigmIt's really too far in advance to imagine what will follow 2018. If the bare bones of PPACA survive what is now the political equivalent of confinement in a concentration camp, it should emerge with determination to replicate or surpass the cost and effectiveness outcomes of the rest of the developed world. At this point we lag far behind in both categories. But there are places in the system that has been in place for years that have been exemplary models which hopefully can be replicated across the country. A handful of selected clinics and geographical areas have been producing good medical outcomes than the rest of the country, and some are doing so at a lower cost per patient. The experimental model being shaped by PPACA is the ACO or Accountable Care Organization. What that means it not clear at this point, but the outlines are beginning to emerge.

- Act Six -- Private & Government Health Care with Private & Single Payer Payment Models We are well on the way to all of these goals.

** Most of American health care is furnished by private sector providers. But we also have a strong and experienced foundation of government health care in the VA, community clinics and the armed forces health care systems. All of these government programs deliver health care for thousands of people, including dependents, at government owned and operated facilities, staffed by government paid health care professionals drawn from the same schools and programs used by the private sector.

** Payment models include mostly private sector insurance plans, now operating in a more equitable and consumer-friendly format, thanks to standards now defined by the law. But we also have single-payer models in Medicare (federally) and Medicaid (states) which handle medical payments (not medical care) through government-run systems not encumbered by expenses faced by the private sector (advertising and marketing, sales commissions, facilities depreciation, loan services, etc.).

The single payer model is less expensive but competition in the private sector appears to yield more flexibility and innovation.

~~~~§§§~~~~

►Accountable Care Organizations (ACO)

Accountable Care Organizations (ACOs) are groups of doctors, hospitals, and other health care providers, who come together voluntarily to give coordinated high quality care to their Medicare patients.

The goal of coordinated care is to ensure that patients, especially the chronically ill, get the right care at the right time, while avoiding unnecessary duplication of services and preventing medical errors.

When an ACO succeeds both in both delivering high-quality care and spending health care dollars more wisely, it willshare in the savings it achieves for the Medicare program.► Is Obamacare a ‘bonanza’ for carriers?

Critics continue to claim Obama made a 'sweet deal' with carriers, but Wall Street says for-profit insurers won't 'make out like bandits'

When Congress passed the Affordable Care Act (ACA) in 2010, critics charged that the Obama administration had “made a deal” with for-profit insurers. In return for industry support, reformers invited the insurers’ lobbyists to the table where they hammered out the details of the bill. There, they agreed to a mandate requiring that virtually all Americans purchase coverage (or pay a penalty), thus guaranteeing that carriers would gain billions in new revenues.

“It pays to be one of the few sellers of a product the government is going to force everyone to buy and provides subsidies to help them do it,” one critic sniped.►Thinking of Joining a Private Health Insurance Exchange? Look Before You Leap.

Employers that have not yet done so will soon have to start making decisions about whether to take advantage of the health insurance Exchanges that are being developed under the Affordable Care Act. Although the public Exchanges that are being created by the government have received most of the attention so far, private Exchanges have also been set up as alternatives to both public Exchanges and current forms of employer-sponsored health coverage. Many private Exchanges are aggressively marketing their services as they compete for business. Before employers sign on, however, they need to do their homework and learn about the various options.

This article focuses on what employers must know in order to make informed decisions about private Exchanges, how they differ from public Exchanges and how to determine if a private Exchange is the right fit for their employees.► Big insurers avoid many state health exchanges

Some insurers pulled out of the exchanges required by the Affordable Care Act as the Oct. 1 launch approached, leaving an uneven patchwork of providers.

So few insurers offer plans on some of the new government health insurance exchanges that consumers in those states may pay too much or face large rate increases later, insurance experts say.

An average of eight insurers compete for business in 36 states that had exchanges run or supported by the federal government last month, the Department of Health and Human Services says. (Idaho has since started its own exchange.) But just because an insurer sells in a state, it doesn't mean it sells in every area of a state so many residents have far fewer options.►Several private insurance exchanges to sell health insurance online in NC

North Carolina will soon have a pair of private insurance exchanges on which residents will be able shop online for individual health insurance plans rather than going through an insurance agent or customer service rep.►Frequently Asked Questions About Private Exchanges

The N.C. Chamber, the state’s business lobby, and Digital Benefit Advisors, a national consulting company, both plan to launch online insurance marketplaces next month. The websites are primarily designed as an online insurance shopping mall for employees, but they will be accessible to the public as well.

Private health insurance exchanges or “private exchanges” have attracted increased attention, especially from employers who are considering new health care strategies based on a defined contribution approach. Specifically, this new strategy leverages the private market-place through private exchanges as opposed to the ACA Exchanges, which are currently not open to large employers. It is also generally combined with an employer using a defined contribution approach to fund the purchase of a health plan.

The Association [of Chief Human Resource Officers] has received several questions about the private exchange – defined contribution approach in connection with our discussion of the approach at the Washington Policy Conference and the October conference calls. Below are some answers to frequently asked questions. Please email any additional questions to Mike Peterson at mpeterson@hrpolicy.org.

~~~~~~~~~~~~~~~~~